In an era where the cosmos is beckoning like never before, visionary entrepreneurs are no longer just dreaming of interstellar adventures—they’re launching them! The space industry has transformed from a niche market into a thriving frontier where innovation meets investment, and venture capitalists are eager to explore new worlds of opportunity. But how can your startup catch the eye of these celestial investors? In this blog post, we’ll guide you through the uncharted territory of space funding, equipping you with essential strategies and insights to elevate your venture among the stars. Whether you’re developing cutting-edge satellite technology or pioneering sustainable lunar habitats, let’s navigate this exciting landscape together and ensure your startup is ready for lift-off!

Introduction to Space Industry and Venture Capital

The stars have never been closer, and the race to explore them is heating up. As technology advances at breakneck speed, the space industry has transformed into a hotbed of innovation and investment opportunities. Venture capitalists are now looking beyond Earth’s atmosphere, eager to fund the next wave of satellite and space exploration startups.

With dreams of colonizing Mars or revolutionizing satellite communications, entrepreneurs are turning their visions into reality. Yet navigating this cosmic landscape can be daunting. Securing funding in such a specialized field requires more than just an innovative idea; it demands meticulous preparation and strategic positioning.

If you’re ready to launch your startup into orbit—or propel it toward uncharted territories—understanding how to attract venture capital is crucial. Let’s dive deep into what it takes for aspiring founders to effectively secure funding for their ambitious projects in the vast realm of space exploration.

Understanding the Unique Challenges in Securing Funding for Space Startups

Navigating the funding landscape for space startups is no small feat. The industry demands innovation, yet it’s fraught with risks that scare off traditional investors.

First, there’s the long timeline from concept to launch. Unlike tech ventures, which can see shorter feedback loops, space projects often take years or even decades to fruition. This delay can deter potential backers who seek quick returns.

Moreover, technological hurdles are significant. Developing hardware for space travel involves complex engineering and hefty investment in R&D. Many investors may lack a deep understanding of these challenges.

Regulatory issues add another layer of complexity. From compliance with international treaties to obtaining necessary permits, the bureaucratic maze can be daunting and time-consuming.

Market volatility also plays a role. Fluctuations in government budgets and changing political climates can directly impact funding availability for space initiatives.

Tips for Positioning Your Startup for Success in Space Funding

Crafting a robust business plan is your first step. It should clearly define your mission, objectives, and the market need you’re addressing. Investors want to see how you plan to navigate this complex industry.

Next, identify potential investors who are passionate about space exploration. Look for venture capitalists with a history of funding aerospace initiatives or those interested in technological advancements.

Highlight what makes your startup unique. Whether it’s groundbreaking technology or innovative applications, showcasing your distinct value proposition will capture attention.

Don’t overlook regulatory challenges. Familiarize yourself with the legal landscape affecting space startups. Having strategies in place to address these hurdles can reassure investors of your commitment and preparedness.

Finally, building relationships within the industry is crucial. Networking can open doors that lead to invaluable partnerships and opportunities for funding that may not be widely advertised.

– Developing a Solid Business Plan

A well-crafted business plan is your roadmap to securing funding for satellite and space exploration startups. It lays out your vision, mission, and objectives in a clear manner.

Focus on detailing your market analysis. Understand the competitive landscape and identify gaps that your startup can fill. This insight showcases potential profitability.

Next, outline your operational strategy. Investors appreciate knowing how you will execute your plans efficiently while managing resources wisely.

Financial projections are critical too. Provide realistic forecasts that reflect both short-term needs and long-term growth.

Lastly, don’t forget about risk assessment. Highlight any challenges specific to the space sector and present strategies for mitigating them effectively.

When investors see a comprehensive plan with foresight, they’re more likely to take an interest in backing you financially.

– Identifying Potential Investors in the Space Industry

Identifying potential investors in the space industry requires a focused approach. Start by researching venture capital firms with a specific interest in aerospace and technology. They often seek innovative companies that push boundaries.

Look for angel investors who have experience in tech or engineering sectors. These individuals can offer not just funds, but also valuable expertise and networking opportunities.

Attend space industry conferences and events to connect directly with interested parties. Building relationships here is invaluable; personal connections can open doors to funding options you might not find online.

Leverage platforms like LinkedIn to identify key players within investment circles focused on space exploration. Engage thoughtfully with their content before reaching out, as this shows genuine interest.

Don’t forget about corporate investors from established aerospace companies looking for new ventures to support through partnerships or investments. Their backing could lend credibility and additional resources to your startup’s efforts.

– Highlighting Your Unique Value Proposition

When seeking funding for your space startup, articulating a compelling unique value proposition is crucial. This statement should clearly convey what sets your venture apart from the competition.

Start by identifying the specific problem your technology addresses in the space industry. Is it cost efficiency? Enhanced satellite capabilities? Or perhaps groundbreaking research opportunities?

Next, emphasize how your solution not only solves this issue but also adds tangible benefits for investors and partners. Illustrate real-world applications that make an impact.

Utilize data and case studies to back up your claims. Numbers resonate with potential investors who seek quantifiable opportunities.

Lastly, ensure that your value proposition aligns with current trends in space exploration and satellite technology. Investors are keenly interested in innovations that fit into broader goals of sustainability or commercialization within outer space sectors.

– Navigating Regulatory and Legal Hurdles

Navigating the regulatory landscape of the space industry can feel daunting. Each country has its own set of laws governing satellite launches and operations. Understanding these regulations is critical for any startup seeking funding.

Licensing requirements are often complex and time-consuming. Startups need to secure necessary permits well in advance, ensuring compliance with both national and international laws. This step not only avoids potential fines but also reassures investors about your commitment to legal standards.

Engaging with government agencies early on can smooth the path forward. They offer invaluable resources and insights into what’s required for successful compliance.

Additionally, consider consulting legal experts who specialize in aerospace law. Their expertise can help interpret intricate rules while guiding you through contractual obligations related to partnerships or funding agreements.

By proactively addressing these hurdles, startups demonstrate their seriousness and readiness—a key aspect that attracts savvy investors looking at funding satellite and space exploration startups effectively.

Case Studies of Successful Space Startups and Their Funding Strategies

SpaceX revolutionized the space industry with its ambitious approach. Founded by Elon Musk, it quickly attracted massive investments by demonstrating reusable rocket technology. Investors saw potential in reducing costs for satellite launches and interplanetary missions.

Blue Origin, led by Jeff Bezos, takes a different angle. Its focus on suborbital flights and tourism captures attention. A mix of private funding and government contracts helped secure its position in the market.

Planet Labs offers yet another perspective. This startup focuses on Earth observation through small satellites. By providing valuable data analytics to various sectors, it secured venture capital from investors eager to tap into the growing demand for sustainability insights.

Each of these successful startups illustrates diverse strategies tailored to their unique goals while navigating the complex landscape of space funding effectively.

– SpaceX

SpaceX, founded by Elon Musk in 2002, has revolutionized the space industry. The company’s ambitious vision is to make life multiplanetary.

Through innovative technologies and a relentless focus on reducing costs, SpaceX achieved remarkable milestones. The Falcon 1 was the first privately-developed liquid-fueled rocket to reach orbit in 2008.

Its most significant breakthrough came with the Falcon 9 reusable rocket. This advancement dramatically lowered launch expenses and opened new possibilities for commercial satellite deployment.

In addition to launching satellites, SpaceX’s Dragon spacecraft transports cargo to the International Space Station (ISS). Its success attracted substantial investment from venture capitalists eager to support its bold mission.

The company’s commitment to innovation and sustainability continues to draw attention at every phase of development. With projects like Starship aiming for Mars colonization, SpaceX remains at the forefront of funding satellite and space exploration startups effectively.

– Blue Origin

Blue Origin, founded by Amazon’s Jeff Bezos, aims to revolutionize space travel. The company’s vision is ambitious: to enable millions of people to live and work in space.

Their flagship rocket, New Shepard, showcases reusable technology designed for suborbital flights. This innovation significantly reduces costs and increases accessibility.

In addition to tourism, Blue Origin has plans for lunar exploration through its lander project—an essential step towards establishing a sustainable human presence on the Moon. Partnerships with NASA further strengthen their position within the industry.

Funding for Blue Origin comes from various sources, including private investments and government contracts. Their strategic approach attracts attention while demonstrating solid growth potential in an evolving market.

The excitement around Blue Origin underscores the growing interest in commercial space ventures as they pave new paths toward humanity’s future among the stars.

– Planet Labs

Planet Labs emerged as a game-changer in the satellite imagery sector. Founded in 2010, it harnesses cutting-edge technology to capture high-resolution images of Earth daily.

Their fleet of small satellites, known as Doves, is designed for efficiency and rapid deployment. This innovative approach allows them to monitor environmental changes, urban development, and agricultural trends with remarkable precision.

Funding played a crucial role in their journey. Planet Labs successfully attracted investments from prominent venture capital firms like Founders Fund and Data Collective. Their compelling vision for global data accessibility resonated well with investors seeking impactful solutions.

Moreover, they tackled challenges by focusing on scalability and partnerships with various organizations. By positioning themselves at the intersection of technology and sustainability, they carved out a niche that appeals to both investors and consumers alike.

Alternative Funding Options for Space Startups

Space startups often face financial hurdles. Traditional venture capital can be hard to secure. Fortunately, alternative funding options offer pathways for innovation.

Crowdfunding platforms have gained traction in recent years. They allow entrepreneurs to engage with the public directly. A compelling campaign can attract not just funds but also a community of supporters passionate about space exploration.

Grants from government agencies present another avenue. Organizations like NASA and the European Space Agency provide funding for projects aligned with their missions. These grants often focus on research and development, enabling startups to advance technology without diluting ownership.

Strategically leveraging these options helps diversify your funding sources. It reduces reliance on single investors while enhancing visibility within the industry’s ecosystem. By tapping into various resources, space startups can chart their own course toward growth and impact in an exciting sector.

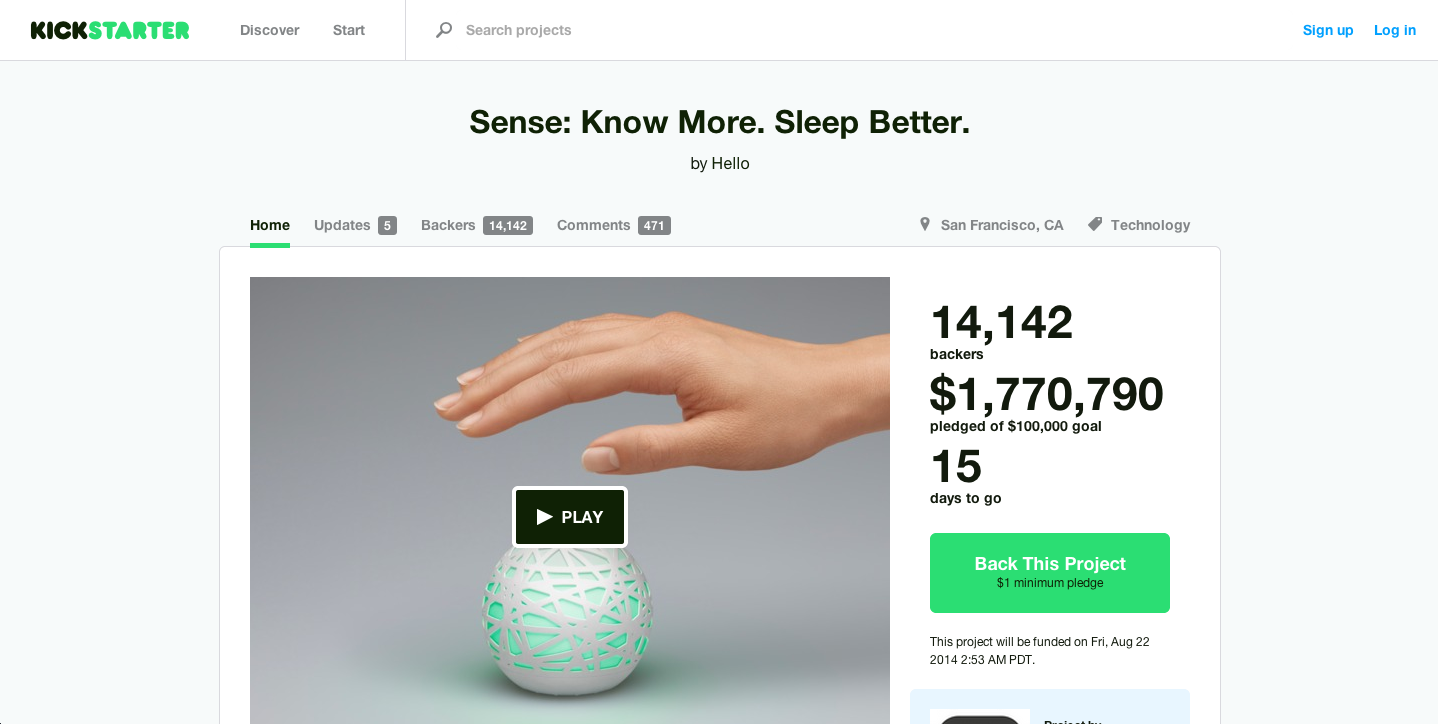

– Crowdfunding

Crowdfunding has emerged as a dynamic avenue for funding satellite and space exploration startups. This method taps into the collective power of individuals who believe in your vision.

Platforms like Kickstarter and Indiegogo allow entrepreneurs to present their ideas directly to potential backers. Engaging storytelling is essential here, capturing imaginations while showcasing innovative concepts.

A successful campaign requires more than just an appealing idea. Building a community around your project fosters enthusiasm and encourages contributions. Social media plays a crucial role in spreading the word and driving traffic to your crowdfunding page.

Offering enticing rewards can also motivate supporters to contribute at higher levels. Whether it’s exclusive merchandise or behind-the-scenes access, these incentives create deeper connections with backers.

Ultimately, crowdfunding not only generates capital but also validates your startup’s concept among early adopters, making it a powerful tool for aspiring space entrepreneurs.

– Grants from Government Agencies or Organizations

Grants from government agencies or organizations can be a game-changer for space startups. These funds are often non-dilutive, meaning you won’t have to give up equity in your company.

Various programs exist aimed explicitly at fostering innovation in the aerospace sector. NASA and the European Space Agency frequently offer grants targeting technology development, research, and exploration initiatives.

Applying for these grants requires thorough preparation. You need to clearly articulate how your project aligns with their mission objectives. Emphasizing potential benefits like advancements in satellite technology or contributions to sustainable practices can make your proposal stand out.

Networking is crucial too. Engaging with agency representatives during workshops or conferences allows you to understand funding priorities better. Building relationships may increase your chances of securing that essential financial support down the line.

Conclusion

As we have discussed, securing funding for a space startup can be an exciting but challenging endeavor. With the growing interest and investment in this industry, it is crucial to position your company strategically and understand the unique factors involved in securing venture capital for space ventures. By following these tips and staying informed on the latest trends and developments, you can increase your chances of success in this competitive market. So reach for the stars, gather a strong team, and prepare to make your mark on the ever-evolving world of space exploration with confidence!