Entrepreneurship isn’t just the backbone of innovation—it’s the powerhouse of economic growth. In the United States alone, 33.3 million small businesses comprise a staggering 99.9% of all enterprises, employing nearly half the workforce at 45.9%. From Silicon Valley startups to main street mom-and-pops, entrepreneurs are the lifeblood of innovation and economic vitality. They’re not just dreamers; they’re doers—creating jobs and pioneering revolutionizing products and services that shape our daily lives. Over the past quarter-century, these nimble ventures have generated almost two-thirds of all new jobs, transforming challenges into opportunities and ideas into realities.

Yet, in today’s rapidly evolving business landscape, entrepreneurs face unprecedented challenges and opportunities. Emerging technologies such as blockchain, cryptocurrency, and artificial intelligence (AI) are dual-edged catalysts, spawning myriad business opportunities while offering innovative solutions to longstanding challenges. From attracting initial investment to managing global workforces and navigating complex financial ecosystems, the path to success is both fraught with obstacles and rich with potential.

At the forefront of this technological revolution, cryptocurrency and blockchain technology are democratizing access to capital and creating new business models in decentralized finance (DeFi) and Web3. Simultaneously, AI-driven tools are revolutionizing financial management and data analytics, unlocking new possibilities for predictive analytics, personalized customer experiences, and automated decision-making processes.

Despite these technological advancements, first-time entrepreneurs face significant hurdles, particularly in attracting investment. Traditional Venture Capital (VC) remains a primary source of capital and expertise, but its exclusive nature often favors serial entrepreneurs, reinforcing a success bias that crowds out new entrepreneurs lacking the pedigree. This creates a classic “chicken-and-egg” scenario, where new entrepreneurs struggle to gain traction without prior success. Despite the barriers, Venture Capital remains a primary choice for many startups, owing to the significant value VCs provide beyond mere capital. These investors offer crucial connections to partners, industry expertise, and strategic guidance that can help remove friction at various stages of the startup journey.

The Rise of Crypto Crowdfunding

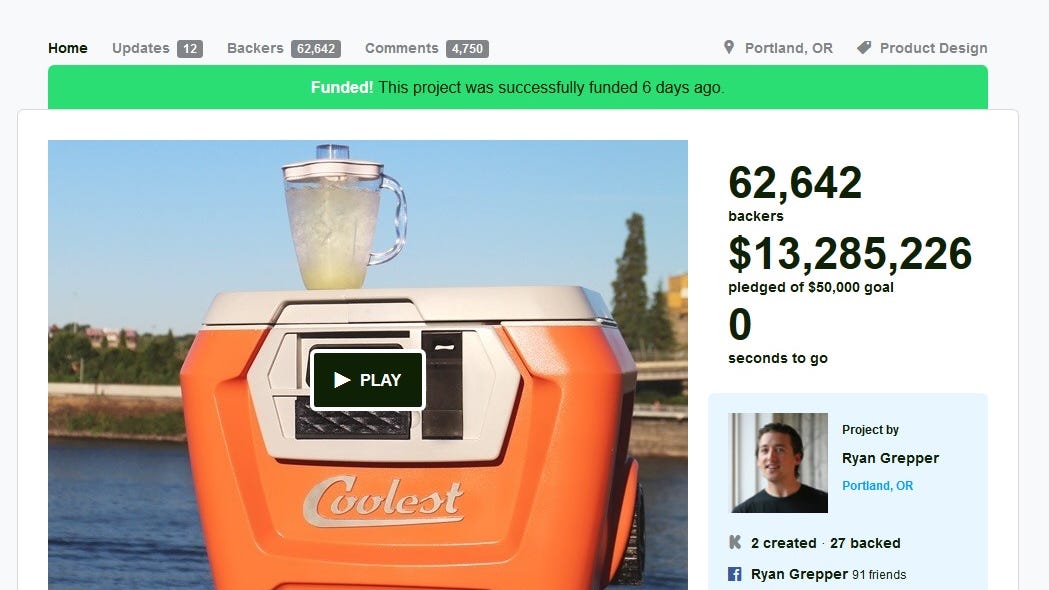

While these challenges persist, the entrepreneurial funding landscape is rapidly evolving, with innovative solutions addressing capital-raising difficulties. Technology is making significant strides in democratizing access to capital. Crypto and blockchain technologies are emerging as alternative solutions to capital-raising difficulties, particularly for first-time entrepreneurs. Crypto crowdfunding platforms enable startups to raise funds from a global investor pool, bypassing traditional gatekeepers. This democratized approach fosters a more inclusive entrepreneurial ecosystem, providing new avenues for innovation and growth alongside established VC channels.

BlastUP is a decentralized launchpad that specializes in crowdsourcing fundraising for cryptocurrency projects. The platform offers a secure, efficient environment for projects to raise capital, with over 80% of payments made in cryptocurrency. BlastUP’s Launchpad Accelerator provides comprehensive support for token launches, including issuance, marketing, fundraising, community building, advisory services, and exchange listings. By streamlining the fundraising process and offering a wide range of tools and resources, BlastUP helps entrepreneurs overcome significant challenges. Built on the Blast Ethereum Layer-2 solution, BlastUP also provides attractive yields to investors through IDO farming and BLASTUP token staking, fostering a mutually beneficial ecosystem. With its commitment to transparency and innovative features, BlastUP optimizes the fundraising process for projects in the competitive crypto market.

Concept of achievement, career, money, growth, finance.

The Rise of Global Entrepreneurship and Challenges

While innovative funding solutions address initial capital needs, the journey of entrepreneurship extends far beyond. Entrepreneurs face new challenges as they scale globally, such as managing an international workforce and navigating cross-border payments. These complexities are especially challenging for small companies with limited resources.

Cross-border payments pose significant hurdles due to diverse regulations, currency fluctuations, and varying payment infrastructures. In emerging markets, where financial ecosystems are less developed and often cash-reliant, tailored solutions are necessary. To address these challenges, innovative payment platforms at the intersection of cryptocurrency and traditional finance are emerging, aiming to simplify international transactions and provide flexible payment options for entrepreneurs.

NOWPayments is a cutting-edge crypto payment processing solution that prioritizes speed, security, and convenience. Supporting over 300 cryptocurrencies, it offers extensive flexibility through features like auto coin conversion and low fees of just 0.5%. NOWPayments accommodates crypto-to-crypto and crypto-fiat transactions and provides tools for crypto payments API, mass payouts, crypto subscriptions, and billing. With advanced 24/7 support and a dedicated account manager, it ensures smooth business operations. Its intuitive system efficiently organizes payments, attaches payments to specific orders, and tracks real-time transactions. Additionally, NOWPayments offers a built-in crypto exchange tool, simplifying transactions for merchants and enhancing the overall payment experience. Customizable solutions and detailed analytics empower businesses to seamlessly integrate crypto payments into their operations, making NOWPayments the ideal choice for digital transactions.

The Importance of Robust Financial Management

As entrepreneurs leverage tools for global expansion, robust financial management becomes even more critical. Operating in multiple markets with various currencies and regulations demands sophisticated oversight. Inefficient processes can lead to severe cash flow problems, missed opportunities, and even bankruptcy. Many startups fail not due to poor products or lack of funding but because of inadequate financial planning. This underscores the importance of maintaining strong financial oversight and management, especially with multiple currencies and international transactions.

Recognizing these challenges, entrepreneurs are increasingly turning to next-generation financial management solutions. The market has responded with tools that cater specifically to growing businesses in a global context. For instance, invoicing tools designed for small businesses streamline billing processes, send automated reminders, and integrate with existing accounting systems. These solutions provide comprehensive financial insights, enhancing cash flow management and ensuring timely payments. By optimizing financial processes, businesses can better position themselves for sustainable growth in an increasingly complex global marketplace.

Accru‘s invoicing tool is an intuitive solution designed for small businesses to streamline invoicing and reduce time spent on payment collection. It sends automated invoice reminders, ensuring faster payments. The tool seamlessly integrates with existing accounting systems for efficient operations. Its comprehensive billing and invoicing dashboard provides clear financial insights, enhancing cash flow management. The user-friendly interface simplifies usage, reducing the learning curve for small business owners. With Accru, businesses can optimize their financial processes, ensuring timely payments and better financial control. Additionally, it offers robust architecture and integration capabilities with various business tools, making it a versatile solution for different sectors. The ease of use and efficient payment collection are key highlights.

While these tools offer significant benefits, they are just the beginning of a broader technological revolution in entrepreneurial finance mangement.

Embracing Innovation for Financial Success

In this complex global startup landscape, transformative technologies are reshaping financial management and operations for businesses of all sizes. The convergence of blockchain, crypto, AI, and other technologies offer numerous opportunities for growth. However, careful consideration and thorough due diligence are crucial. The right balance of adaptability and cautious implementation can transform obstacles into opportunities for sustainable growth.

By embracing innovations while maintaining sound financial practices, entrepreneurs can position themselves at the forefront of economic progress in an interconnected world. Entrepreneurs who successfully navigate these challenges and leverage emerging technologies will be well-positioned to lead the next generation of innovative, globally competitive enterprises.

Source: bing.com