As discussed in our prior post, the Securities and Exchange Commission’s Office of the Advocate for Small Business Capital Formation recently issued its 2024 Annual Report.

The Report provides data on the reliance on crowdfunding and Regulation A to raise capital. Interestingly, the number of new crowdfunded offerings has remained fairly consistent with the higher levels of activity that we began to observe during the pandemic periods. In terms of the types of companies that are undertaking these offerings, 19% of the businesses have previously secured equity funding and 53% generated revenue. Almost half, or 48%, are two to three years old and more than half, or 61%, have two to five employees. The median raise in 2023 was $106,000 and the average raise was $368,000. The average investor check size in an offering is $1,200. While the companies undertaking these offerings are fairly geographically dispersed throughout the country, there are significantly more on either coast, with the greatest number in California, followed by New York. The overall number of Regulation A offerings, on the other hand, continues to decline although the number of offerings raising more than $50 million has remained relatively stable. Once again, companies in California and New York lead in number of completed offerings.

The Report provides a little insight on governance trends at private companies. In recent years, the Report notes, private companies have increased their share of independent directors—in 2023, board composition broke down as follows: 31% independent directors; 23% executives; and 46% investor representatives. This compares to 2019 when independents accounted for only 20% of board seats. According to a study cited by the Report, companies with an independent director raise 26% more funding than those with no independent director.

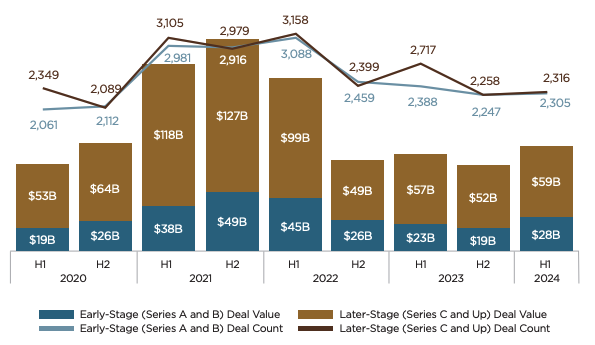

Venture capital investment activity in 2023 remained steady though lower than 2021 and first half 2022 levels. There has been a modest increase in activity in the first half of 2024 especially in later stage rounds. Median and average deal sizes have generally increased from 2023 to the first half of 2024. In the second quarter of 2024, 17% of deals were down rounds, compared to 20% in the same quarter of 2023. The median time between funding rounds remains significant, with approximately 27 months elapsing between Series B and Series C rounds.

For additional details on emerging company trends and VC funding trends, access the full Report.

[View source.]