“Shark Tank” star Kevin O’Leary wants to buy TikTok with the help of investors willing to pitch in for a stake in the Chinese-owned app.

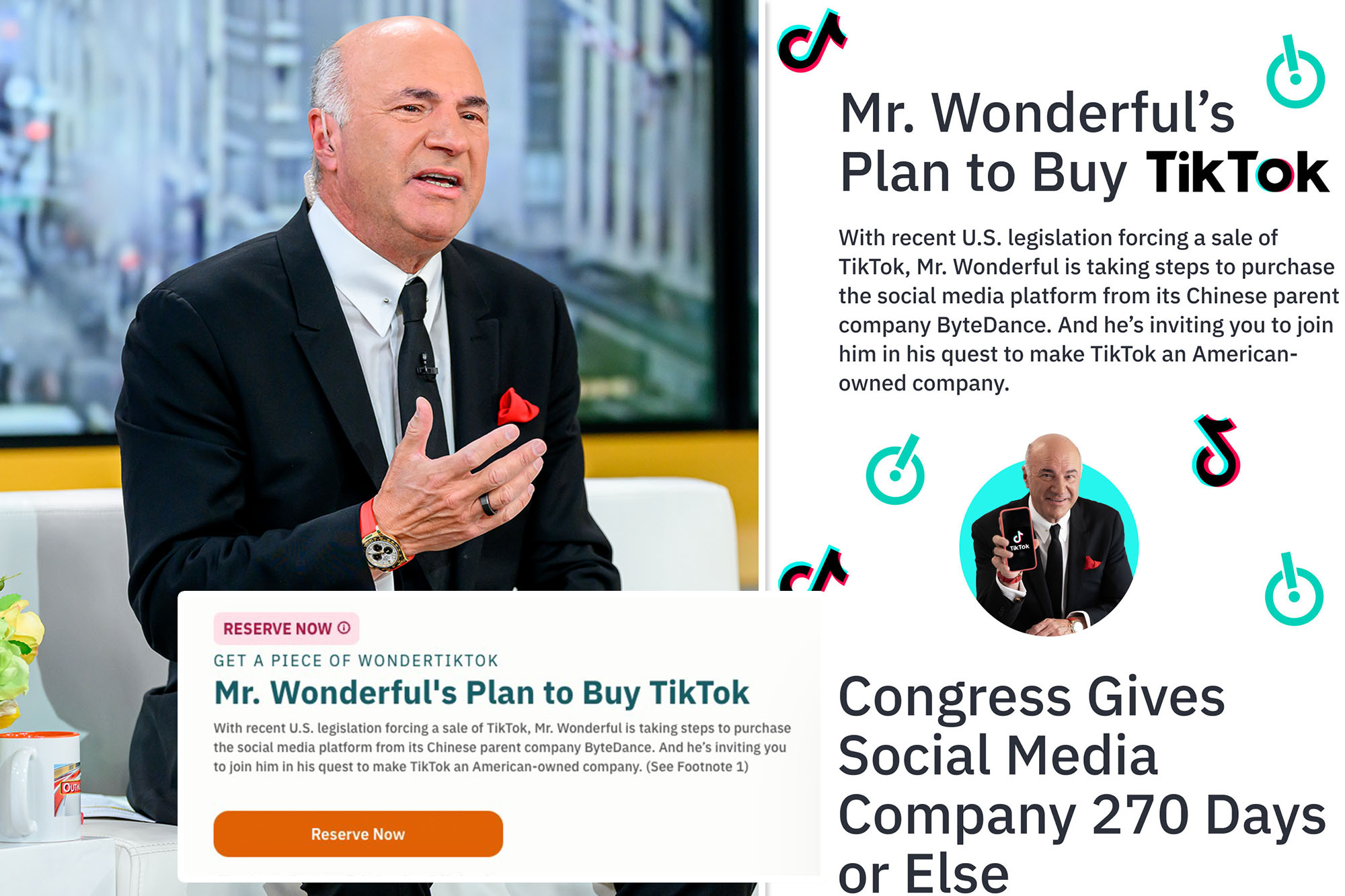

O’Leary, the Canadian-born investor known as “Mr. Wonderful” for his skeptical persona on the hit reality television show, started a crowdfunding effort online to gauge public interest in helping him “in his quest to make TikTok an American-owned company.”

In response to a recent US law requiring China-based ByteDance to divest from its US holdings and sell TikTok’s American-based operations, O’Leary posted an item on the StartEngine crowdfunding site titled “Mr. Wonderful’s Plan to Buy TikTok.”

O’Leary bills himself as a “renowned entrepreneur” who is “known for his sharp business acumen” as proven by his $3.8 billion sale of his software firm The Learning Company.

The investor is not soliciting funds just yet. Instead, he is inviting would-be investors to make a reservation — a “non-binding” move whereby “no money changes hands.”

At a later date, O’Leary will inform would-be investors when the offering launches so that they can then make a decision whether to commit funds to the process.

According to StartEngine, the offering is a “Regulation A+ Test the Waters” offering, which means it is open to the public.

In March, O’Leary told Fox News that he would either buy TikTok or join a syndicate that plans on buying it.

“Not going to get banned because I’m gonna buy it,” O’Leary said. “Somebody’s going to buy it. It won’t be Meta, and it won’t be Google because a regulator will stop that.”

O’Leary said that TikTok, with its more than 1 billion monthly active users worldwide and $16 billion in US revenue annually, is “worth billions.”

“It’s one of the most successful advertising platforms in social media today,” O’Leary said. “All my companies use it. I’ll buy it.”

O’Leary is the latest US-based businessman who has expressed interest in acquiring TikTok.

Bobby Kotick, the former CEO of video game maker Activision Blizzard, has reportedly discussed buying TikTok.

Earlier this year, Steve Mnuchin, who was Treasury secretary under then-President Donald Trump, said he was assembling a group of investors to buy TikTok.

In 2020, Oracle co-founder Larry Ellison teamed up with Walmart in an attempt to buy a stake in TikTok’s US operations.

But that effort failed when TikTok successfully challenged a Trump administration order requiring it to sell its US operations to an American company.

The Post has sought comment from TikTok.

Last month, Reuters reported that TikTok’s China-based parent company would prefer to shut down the app rather than sell it if all legal options are exhausted in its fight against the recently enacted law.

Sources close to ByteDance told Reuters that the algorithms that TikTok relies on for its operations are deemed core to the parent company’s overall operations — making the sale of the app highly unlikely.

TikTok accounts for a small share of ByteDance’s total revenues and daily active users, so the parent would rather have the app shut down in the US in a worst case scenario than sell it to a potential American buyer, they said.

A shutdown would have limited impact on ByteDance’s business while the company would not have to give up its core algorithm, said the sources, who declined to be named as they were not authorized to speak to the media.

President Biden signed into law a measure that gives ByteDance until Jan. 19 to find a US-based buyer.

Biden could extend the deadline by three months if he sees that ByteDance has made progress in divesting of its US-based operations.

ByteDance does not publicly disclose its financial performance or the financial details of any of its units.

The company continues to make most of its money in China, mainly from its other apps such as Douyin, the Chinese equivalent of TikTok, separate sources have said.

ByteDance’s 2023 revenues rose to nearly $120 billion in 2023 from $80 billion in 2022, said two of the four sources.

TikTok’s daily active users in the US also make up just about 5% of ByteDance’s daily active users worldwide, said one of the sources.

TikTok shares the same core algorithms with ByteDance domestic apps like short video platform Douyin, three of the sources said.

Its algorithms are considered better than ByteDance rivals such as Tencent and Xiaohongshu, said one of them.

It would be impossible to divest TikTok with its algorithms as their intellectual property license is registered under ByteDance in China and thus difficult to disentangle from the parent company, said the sources.

Moreover, separating the algorithms from TikTok’s US assets would be an extremely complicated procedure and ByteDance is unlikely to consider that option, the sources added.

With Post Wires