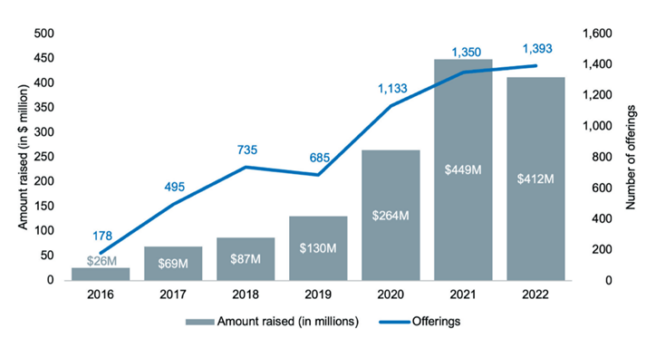

A musician seeking crowdfunding to produce a recording of Bach’s music on the accordion is not as innovative as initially thought, as there are already numerous accordion players performing Bach’s music. Real estate sponsors also seek innovation but tend to stick with familiar securities exemptions when selling real estate securities, according to statistics from the Securities and Exchange Commission (SEC) Small Business Advocacy Office (SBAO) Annual Report. The most popular exemption for real estate securities is Rule 506(b) of Regulation D, followed by Rule 506(c). Rule 504 and Regulation CF are also used but have limitations. Regulation A (Reg A+) is a streamlined registration process that allows companies to raise up to $75 million in a 12-month period. Rule 506(b) offerings dominate due to their unlimited fundraising potential and reasonable cost. Rule 506(c) offerings are increasing in popularity as the number of accredited investors grows. The SEC is faced with the dilemma of tightening the accredited investor definition or expanding it to provide more people with access to Rule 506(c) offerings. The decision will impact the popularity of Rule 506(c) offerings and the ability of individuals to invest in real estate through funds.

Real Estate Companies Continue to Favor Rule 506 Offerings | JD Supra

In conclusion, while Regulation CF offers a new option for equity crowdfunding, real estate companies still tend to favor Rule 506 offerings due to their flexibility and established track record. It is important for companies to carefully consider their options and choose the exemption that best fits their specific needs and goals.