A musician seeking funds to produce a recording of Bach’s music on the accordion has sparked curiosity and discussion. While the accordion was not invented during Bach’s time, the musician’s performance on the instrument showcases its versatility and ability to capture the essence of Bach’s music. However, it turns out that this idea is not as innovative as initially thought, as there are already numerous recordings of Bach’s music performed on the accordion available online.

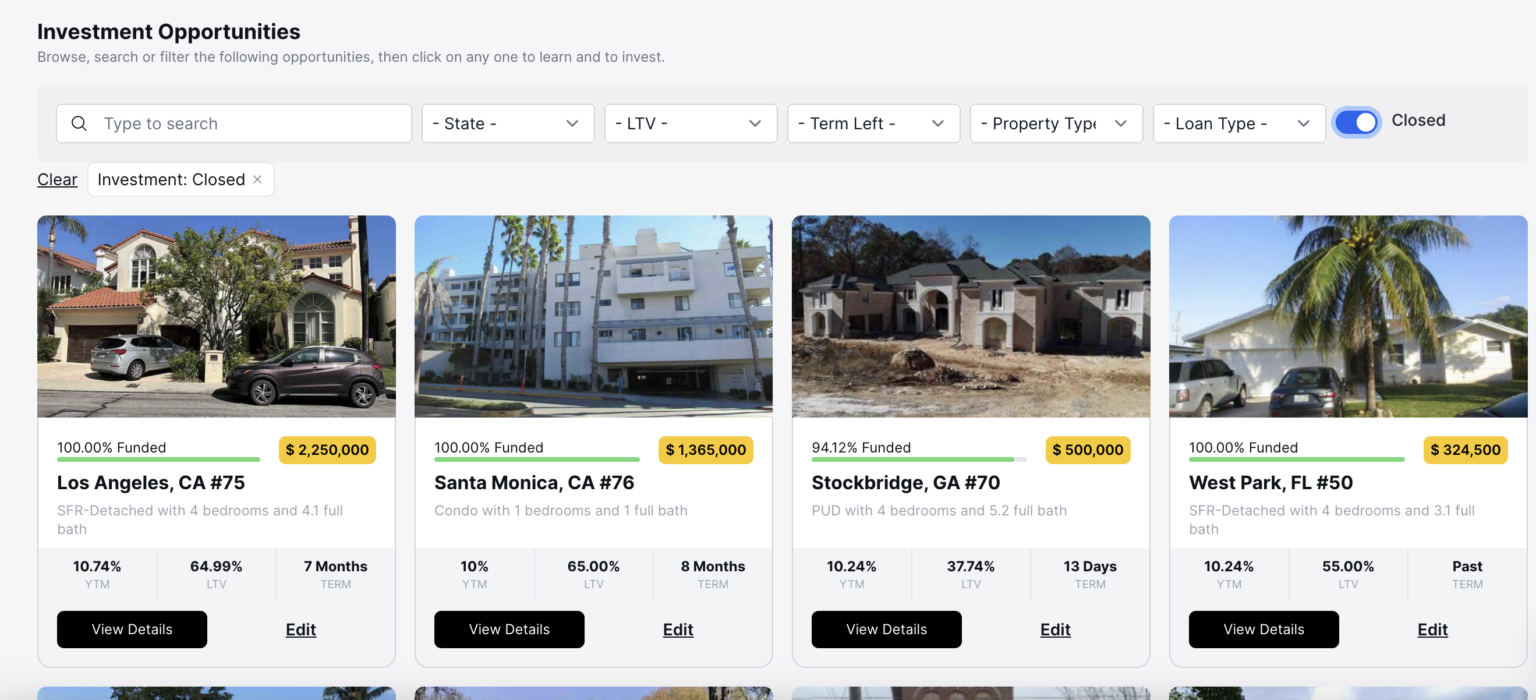

Similarly, in the real estate industry, sponsors often strive to be innovative and explore new opportunities such as crowdfunding and online selling platforms. However, according to the Securities and Exchange Commission (SEC) Small Business Advocacy Office (SBAO) Annual Report, most sponsors still rely on familiar securities exemptions when selling real estate securities. The report also highlights potential limitations to future access to certain exemptions due to changes in accredited investor requirements.

The article provides an overview of the different securities law exemptions for real estate securities. It explains that the majority of unregistered real estate securities use the private placement exemption under Rule 506(b) of Regulation D. Rule 504 allows general solicitation but has limitations and compliance requirements under state securities laws. Rule 506(c) allows public advertising but restricts sales to accredited investors. Regulation CF enables equity crowdfunding but has restrictions on the type of companies that can use it. Regulation A+ is a streamlined registration process that allows companies to raise larger amounts but requires SEC review.

The SBAO Report analyzes the capital raised through different exemptions and reveals that Rule 506(b) remains the most popular choice among small businesses, including real estate businesses. Rule 506(c) offerings have gained attention but have a lower median raise and require more scrutiny into investors’ financial situations. Regulation CF and Rule 504 offerings have raised smaller amounts, and other exempt offerings and registered funds have seen significant capital inflows.

The article discusses why Rule 506(b) offerings continue to dominate, citing their cost-effectiveness, lack of SEC and state review, and the ability to raise funds from friends and family. Rule 506(c) offerings are also cost-effective but can only be sold to accredited investors, which may deter some investors due to the verification process. Established sponsors with existing investor relationships may prefer Rule 506(b) offerings, but as Millennials become a larger part of the investor base, sponsors may need to consider using social media and other public-facing communication methods, which require Rule 506(c).

The article also highlights the increasing popularity of Rule 506(c) offerings due to the growing number of accredited investors. The SEC’s Accredited Investor Report shows a significant increase in the number of households qualifying as accredited investors. This increase is partly due to inflation but also reflects changes in retirement benefits and the inclusion of retirement assets in net worth calculations. The report mentions concerns raised by the National Association of State Securities Administrators (NASAA) about the ability of newly accredited investors to protect their assets and recommends adjusting net worth thresholds.

The SBAO Report recommends maintaining the current accredited investor thresholds and expanding the definition to include additional professional criteria. The SEC’s decision on whether to tighten or expand the accredited investor definition will impact the popularity of Rule 506(c) offerings and the accessibility of real estate investments for different populations.

In conclusion, just as Bach’s music can be performed on various instruments, real estate sponsors have different options for selling securities. While some exemptions remain popular, others are gaining attention. The SEC’s decision on the accredited investor definition will shape the future landscape of real estate securities offerings.