It can be a profitable business to flip properties, but in many cases, it involves quite a bit of capital. Therefore, understanding what is creative financing becomes an important aspect. In other words, creative financing offers an array of innovative solutions to fund property flips, apart from using traditional loans. With these ingenious funding techniques, investors can procure, renovate, and sell properties truly at their own pace and profit. Here are some practical tips for investors who want to use creative financing to flip properties.

1. Understand the Market

Understanding the local real estate market is one of the fundamental factors before venturing into property flipping. Study local property values, trends, and demand to know what property to flip, as well as the amount to expect from each deal.

2. Leverage Hard Money Loans

These are short-term, high-interest loans made on real estate as security. It is a very good source for property flips as it allows getting the money really fast. Higher interest rates might be a drawback, but the speed and flexibility of a hard money loan can be a good advantage for a quick closing in an investment transaction.

3. Private Money Lenders

Private sources of money lenders are those types who lend money to a real estate investor. They have milder terms and faster application procedures than banks. Building relationships with private lenders can provide a steady source of funding for your property flips.

4. Consider Seller Financing

In seller financing, the seller becomes the lender. He advances cash to the buyer by providing a loan. This may have easier terms and doesn’t usually require a large down payment. It’s a good way of getting into properties without having to use the conventional route in the bank.

5. House Hacking

House hacking is acquiring a multiunit property, wherein one unit becomes the owner’s home and the remaining units are let out to pay off the mortgage, hence saving you more money on which you may be using to purchase future properties.

6. Joint Ventures

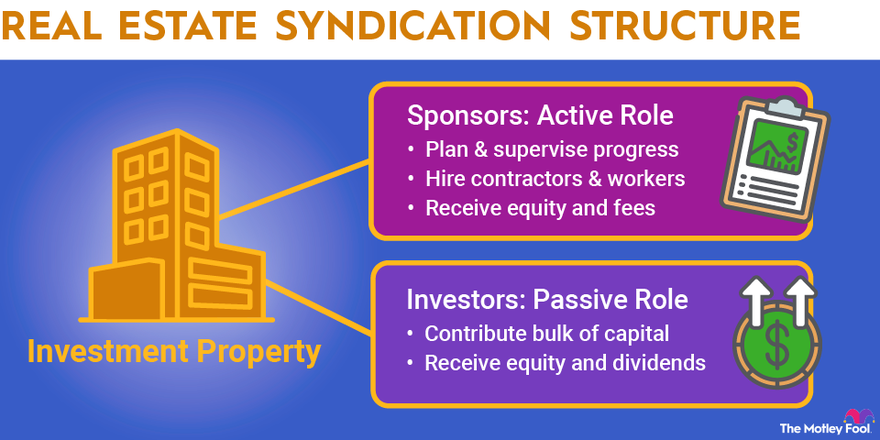

Forming a joint venture with other investors can give you a boost in capital and resources. You can also pair up with others to share the risks and rewards of property flipping, making bigger or more complicated projects easier to tackle.

7. Use Lease Options

It would be a rent-to-own arrangement or even a lease option in which you’d lease the property and then decide later on to buy it. This is going to give control over the house while allowing rental income in the meantime to finance your subsequent purchase and eventual flipping.

8. Crowdfunding

Real estate crowdfunding also enables you to pool funds from other investors together to finance real estate flips. Thus, it would be possible for you to find bigger projects to flip and diversify yourself without having high capital upfront.

9. Remain Organized and Plan

Always, property flippers need organized planning. As such, maintain a detailed budget, timeline, and strategy while flipping each particular property. Monitoring your expenses helps you stay the course and make a good decision at appropriate times.

Conclusion

Flipping properties with creative financing offers a range of innovative solutions to fund your investments. By leveraging strategies like hard money loans, private money lenders, and seller financing, you can overcome financial barriers and achieve profitable flips. Remember to stay informed, plan meticulously, and explore various funding options to maximize your success in the property flipping market.