The crowdfunding market is set for another breakthrough this year: participants in Lithuania are likely to surpass the €300 million mark in attracted investments and will increasingly look abroad, as there are virtually no barriers left to expand their business models into other European countries.

The crowdfunding market in Lithuania, which has been around for less than a decade, has developed very rapidly. It was established in 2016 when the Lithuanian Crowdfunding Law was passed. A year later, the first million euros were invested through crowdfunding platforms (CFPs), and there were five participants in the market.

The most significant market shift was triggered by the global pandemic in 2020, which marked the beginning of rapid growth in the CFP market.

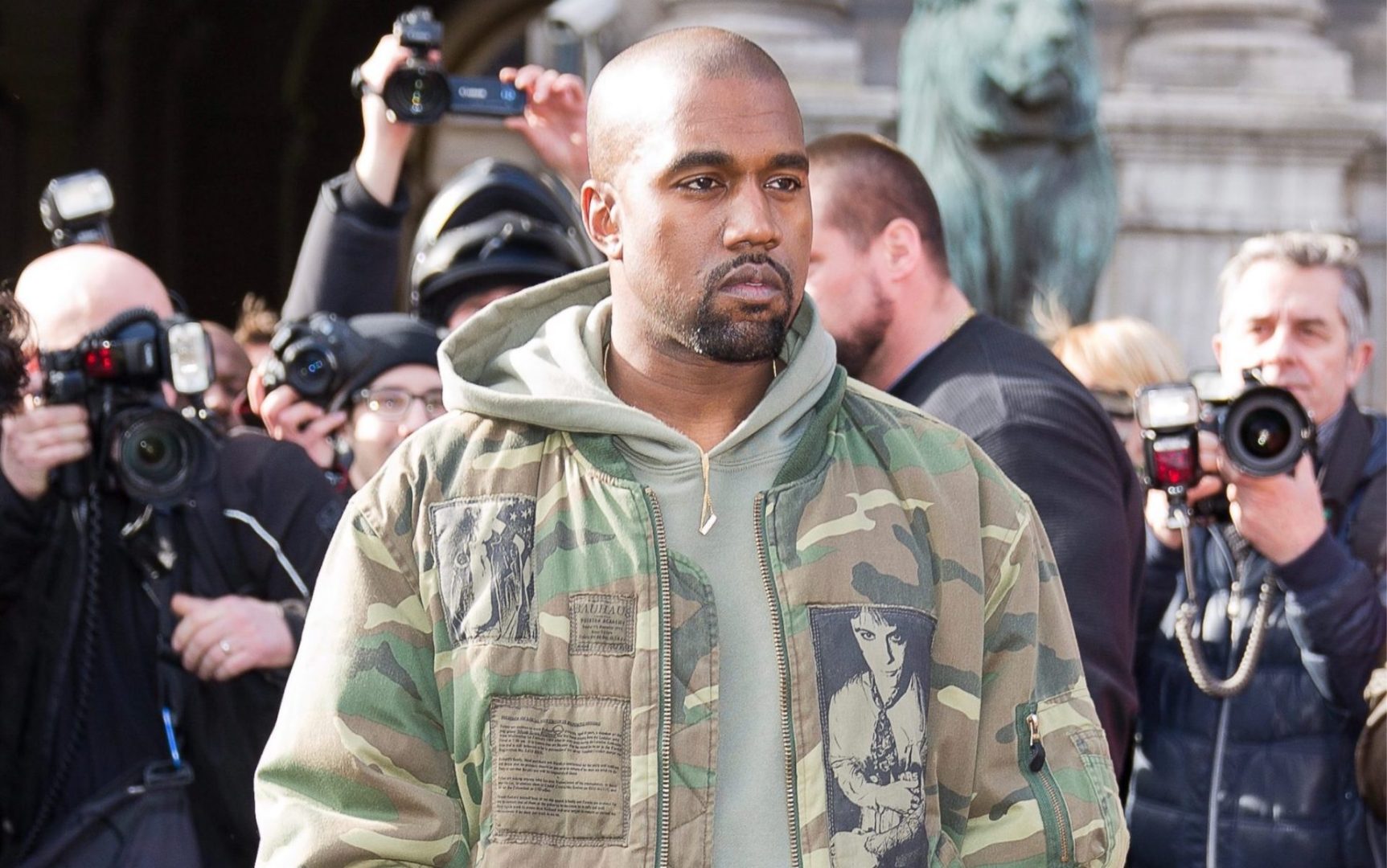

“During that time, all CFPs grew significantly. People found more time during the pandemic. I, myself, started actively investing, as it was a great time to learn, understand, and realize that money sitting idle in an account loses value over time. Many people then understood that investing is simple and can be done from home without committing large sums,” says Lina Maskoliune, CEO of the crowdfunding platform “Profitus.”

However, Maskoliune considers 2024 the beginning of a new era for crowdfunding, as the adaptation period to the common European Union (EU) regulation, introduced in 2023, has ended.

“2024 is somewhat the start of a new era in crowdfunding. With the end of the adaptation period, there is more clarity and safety for investors in the market. Today, we can invest through CFPs with more confidence than before,” Maskoliune asserts.

It is projected that the investments attracted through CFPs in Lithuania this year will reach €300 million (compared to €230 million in 2023), and by 2028, this figure is expected to reach €211.9 billion across Europe.

Fewer Players, More Opportunities

Lithuania ranks third in Europe in terms of the amount raised and the number of platforms, behind Germany and France.

Before the common EU crowdfunding market regulations came into effect, there were 23 CFP operators in Lithuania; today, only 12 remain. “Profitus” holds the largest market share, at 28%, when considering attracted investments.

Maskoliune explains that while the common EU regulations reduced the number of market players, they also provided more opportunities for business expansion in other countries.

“European licenses have made it easier for all platforms to enter other markets. I believe we will see both local participants trying to expand abroad and foreign CFPs entering the Baltic States. Today, there are very few barriers left to entering other markets,” says the “Profitus” representative.

It is natural that with the rapid emergence of CFPs, not all of them have been equally successful, and those with the fewest investors and least attractive projects are doomed to disappear or merge with others.

According to Maskoliune, one of the main trends in the crowdfunding market today is the consolidation of platforms.

“The most valuable asset of any platform is the number of investors. Platforms that are less successful and have fewer clients will be forced to merge, and some smaller players will be absorbed by larger ones. This consolidation will allow larger platforms to undertake bigger projects. We will soon see how well platforms are performing, how well they manage to maintain a safe portfolio, and how many non-performing loans they have. Those platforms that perform well will be strong, attract more money, and their funding will be relatively cheaper,” Maskoliune says.

Today, crowdfunding platforms also create increasing competition for traditional financial market players. This trend should become even more apparent as interest rates decrease, Maskoliune notes.

“Naturally, all platforms want to lend as cheaply as possible to project owners, so we will see competition with traditional financial market players becoming fiercer. We can already feel it—the growing influence of crowdfunding is perhaps slightly irritating to traditional financiers,” Maskoliune believes.

On the other hand, platforms are now ready to collaborate with other financial sector players, issuing bonds and developing joint projects with investment funds, banks, and others.

The Influence of Small Investors and Sustainability

A growing trend highlighted by the “Profitus” business development manager is the increasing significance of small investors.

“Small investors, when united, are a formidable force. At ‘Profitus,’ we strongly believe in small investors. Our database is largely composed of small investors. Interestingly, small investors have certain strengths—they are much more resilient to economic fluctuations than larger ones,” says Maskoliune.

As an example of how important small investors can be to the market, Maskoliune cites the cases of “GameStop” and “AMC Theatres,” where a community of small investors, mobilized via social media, massively bought shares of companies going through tough times, significantly increasing their value and even influencing the actions of large investors.

Of course, the crowdfunding market has not been immune to global sustainability trends, driven by increasing pressure from market regulators and environmental demands.

“Today, there is a demand for projects to ensure social responsibility and adopt sustainable solutions. We have also incorporated criteria into our algorithms that indicate how sustainable specific projects are,” explains the company’s representative.

Artificial intelligence technologies, which CFPs are beginning to use to develop new products, are also expected to provide new opportunities for platforms.

Talking more About Money

Despite the rapid market growth, Maskoliune believes that the true potential of crowdfunding would become evident if a larger portion of Lithuanians started investing actively, and if deposits were no longer the only known way to protect savings from devaluation.

“In Lithuania, only about 4% of the population actively invests, although the amount of money held in deposits by residents and companies is as high as €33 billion. The phrase ‘time is money’ may seem cliché, but in this case, it is very accurate. Your money doesn’t like time. Why don’t we want to be wealthy, why don’t we want to talk about money, why does it make us uncomfortable?” Maskoliune asks rhetorically.

According to her, in Lithuania, unlike in Scandinavia, for example, many people still feel uneasy about saying or asking how much someone earns or where they invest, even though talking more about money would increase our knowledge and opportunities to attract it.

“This stems from a poverty mindset. It is a deep-seated belief that having money is shameful or negative. This mindset holds us back from participating in financial markets. We can indeed talk about money just like we talk about the weather, food, or health,” Maskoliune believes.

Founded in 2018, “Profitus” brings together a community of over 39,000 investors. Over six years, 1,450 real estate projects have been funded, with more than €200 million raised, of which €133.8 million has already been successfully repaid. The average annual return is as high as 12.14%. Currently, the company’s active loan portfolio amounts to €56.6 million, with investors earning over €11.8 million. The platform operates in four countries—Lithuania, Latvia, Estonia, and Spain.