A Bucks County startup making an alternative real estate investment marketplace has rebranded: The company formerly known as Yieldeasy is now Finresi.

The new name squishes together the words finance and residential.

“I think this really helped us to brand ourselves as the domain experts in investing in real estate financials or real estate debt as an asset class,” Finresi cofounder Jeff Gopshtein told Technical.ly.

The Newtown-based company pivoted last spring from being a marketplace for buying apartment buildings to allowing investors to invest in property loans and participate in real estate debt. After pivoting, Yieldeasy launched its new platform last August. It relaunched its platform under the Finresi brand two weeks ago, and has added 700 new users.

The overall platform is the same, but it has a wider variety of real estate offerings, both in smaller real estate markets and fast growing markets, Gopshtein said. There’s also a wide variety of loan sizes, to attract more investors, he said.

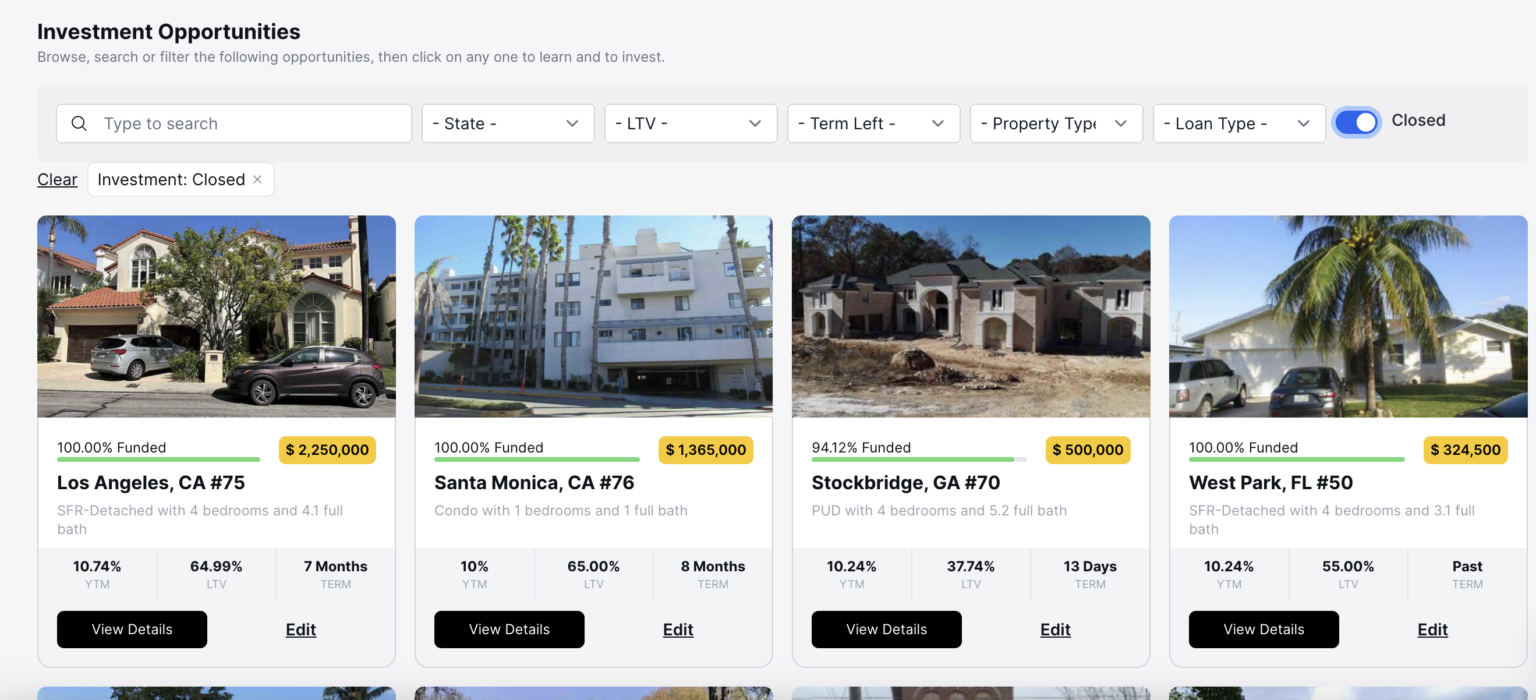

Finresi’s overall look has been updated with a more user-friendly dashboard that makes it easier for investors to research loans.

The company is looking to make it easier for accredited investors to invest in real estate without having to be a property owner. Users can invest in properties alongside lending partners, taking a share of the loan. When property owners make loan payments, investors receive a monthly return. When the loan is fully paid, they receive their principal investment back.

The process of real estate crowdfunding, where an investment property is funded by multiple sources, has seen increased popularity. Finresi is focused on debt investments which can have lower risk, but lower potential returns compared to equity investments, according to Investopedia.

Along with the rebrand, the company announced it raised a total of $1.3 million for its seed round. This is a continuation of the $1 million raise from this past fall, raising an additional $300K over the last six months.

Summersault Ventures led this round with Alumni Ventures, Ben Franklin Technology Partners and a few angel investors also contributing.

This funding will primarily go towards business development and marketing, Gopshtein said. As part of the business development arm, the company brought on Christian Leon as SVP of investor relations, raising Finresi’s full time headcount to three people.

Eventually, Gopshtein would like to expand the types of real estate on the platform and expand the product offerings for users. Short term, he hopes to raise another funding round at the end of this year.

“I think for us providing the exposure to real estate without the traditional risks that come with it by being on the debt side,” Gopshtein said, “is really the most exciting for us.”

Sarah Huffman is a 2022-2024 corps member for Report for America, an initiative of The Groundtruth Project that pairs young journalists with local newsrooms. This position is supported by the Lenfest Institute for Journalism.