Best Passive Real Estate Investments: The Lazy Investor’s Guide

The Big Picture On The Best Passive Real Estate Investments:

I’ve owned dozens of rental properties since 2005. Today, however, I own none.

Why the change of heart? Did I stop believing in real estate as a means to reach financial independence and early retirement?

Not at all. I’ve just changed how I invest in real estate. I leave the renovations and renter phone calls at 2 AM to the scrappy young investors who don’t mind all the headaches.

Today, I own over 2,800 units across the U.S., and I never field a phone call or negotiate with contractors. But I still get all the tax advantages, rental cash flow, and appreciation that active investors earn.

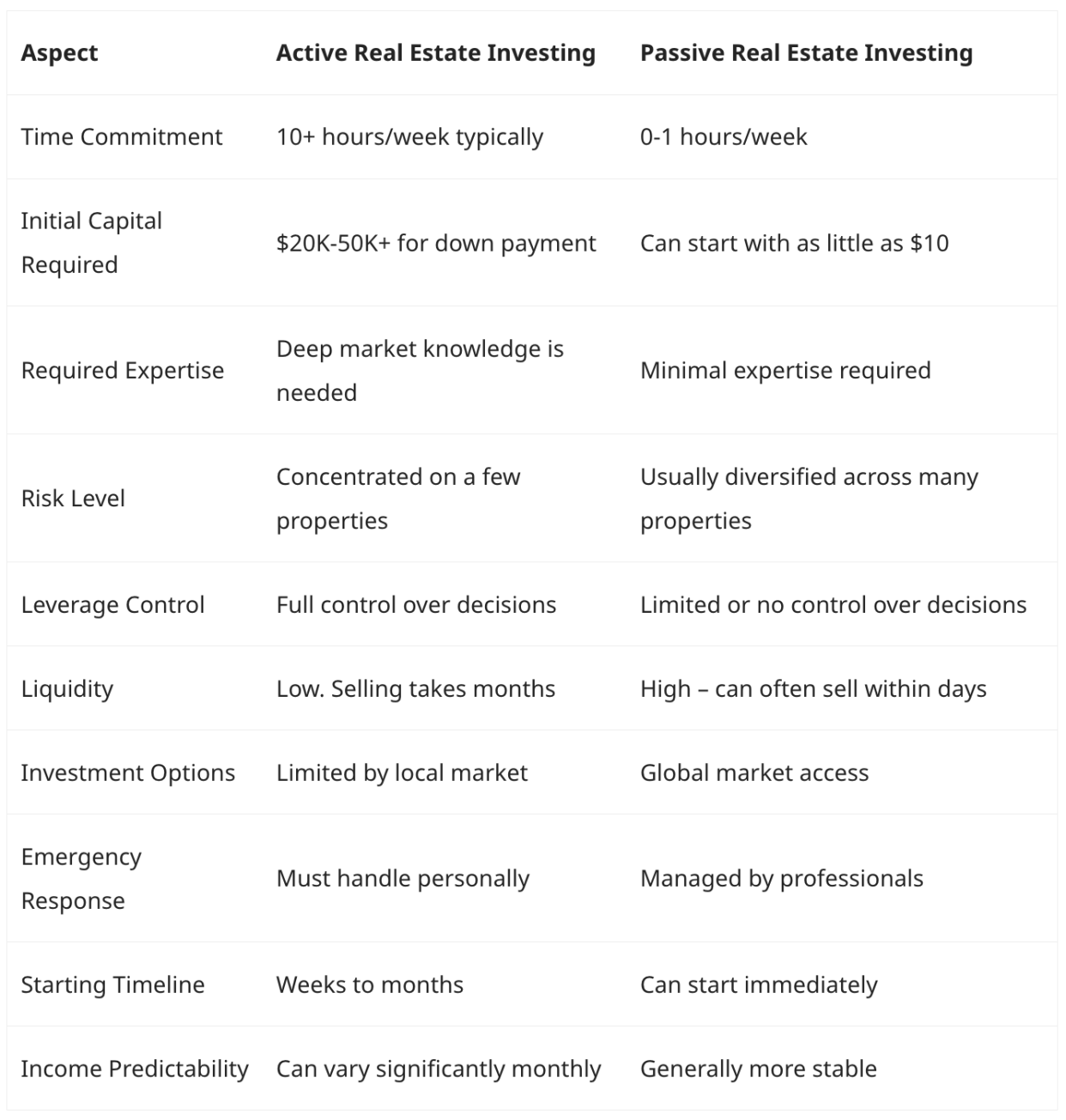

Active vs. Passive Real Estate Investing

Everybody understands active real estate investing. You know how flipping houses or becoming a landlord works. You come up with a down payment, get an investment property loan, perhaps make some property repairs, and either sell or keep the property as a rental.

Don’t get me wrong, it comes with plenty of advantages. When flipping houses, you can earn a relatively quick return in the tens of thousands. Landlords score great rental property tax deductions and earn “forever income” through rental property cash flow while their renters pay off their mortgages. The property appreciates over time, and rents rise over time, even as your mortgage payment remains fixed (why real estate protects against inflation).

For all those upsides, direct real estate investing comes with its share of downsides. It takes enormous amounts of work: work to find good deals on properties, work to find financing, work to oversee and negotiate with contractors, work to advertise vacant units and screen tenants, sign leases and collect rents, and maintain units over time.

I’ve done all of that work. And while I didn’t mind it initially, I eventually got sick of it.

After moving abroad, I started researching other ways to invest in real estate—options that didn’t involve active investment and all those headaches but still delivered all the benefits of real estate investing.

Investment Strategy Comparisons

Let’s cut straight to the chase and look at what separates these two investment paths.

What Is Passive Investment in Real Estate?

Put simply, passive real estate investing just involves your money, not your time.

Passive real estate investment doesn’t require buying properties, arranging financing, renovating or repairing, or managing renters. You simply write a check and sit back while the rental income flows in, the properties appreciate, or interest collects.

Like active real estate investing (and stock and bond investing, for that matter), passive investing comes with risk.

Now that you get the distinction, how do you actually invest passively in real estate?

8 Options for Passive Investment in Real Estate

Fortunately, you have countless ways to invest in real estate passively. They typically fall into one of these eight broad buckets.

Explore these to decide which passive real estate investing option fits your goals best.

1. Public REITs

I’ll be honest: I don’t love publicly traded REITs. But they’re the option that most investors know best, so we’ll start there.

Real estate investment trusts are publicly traded companies that meet certain SEC criteria. At least 75% of their assets must be backed by real estate, and they must pay out at least 90% of their profits each year to investors in the form of dividends, among other requirements. Like any other stock, you can buy and sell them on public stock exchanges through your brokerage account. Similarly, you can buy shares in ETFs or mutual funds that own multiple REITs.

While that all sounds great on paper, REITs have one huge drawback that defeats the purpose of “diversifying into real estate.” They’re just too correlated with stock markets. When the stock market crashes, public REITs crash alongside them — even when the underlying real estate assets are doing just fine.

Go a little further afield for passive real estate investments. It’s worth the (small) extra effort.

2. Private REITs

Not all REITs trade on public stock exchanges. Over the last decade, some real estate crowdfunding companies have launched their own private REITs.

Rather than buy shares through your brokerage account, you buy them directly from the crowdfunding platform. Because they don’t trade on a secondary market, they don’t come with the volatility of stocks.

However, that also raises their greatest downside: lack of liquidity. You can only sell shares back to the crowdfunding company, and most charge an early redemption penalty if you do so within three to five years.

If you can live with the long-term commitment, they offer all the other benefits promised by public REITs. You get the ongoing passive income from dividends, the appreciation, and the tax benefits. Perhaps most importantly, you get true diversification from the stock market.

Like publicly traded REITs, private REITs might own properties directly (equity REITs) or own debt secured by property (mortgage REITs). Or they might own a blend of the two, as many Fundrise REITs do.

Real estate investment trusts offer a simple way to invest in many different real estate markets with a single click. Some, like Fundrise, even include single-family homes, among other investment properties.

3. Crowdfunded Loans Secured by Real Estate

Some real estate crowdfunding companies let you pick and choose individual loans to fund.

My favorite of these is Groundfloor. You can invest as little as $10 toward individual loans secured by properties (although the minimum initial transfer to open an account with Groundfloor is $1,000).

These are short-term purchase-rehab loans to real estate investors, paying 7.5-15% interest. They typically repay in full within 6-24 months, and you can see the repayment term when you invest. Since its launch in 2013, Groundfloor has returned remarkably consistent returns of around 10% when you average all loans together each year.

For an entirely different model, check out Concreit. They offer a pooled fund model, where you invest in a combined fund rather than picking and choosing loans. It pays lower returns in the 5.5-6.5% range, but here’s the kicker: you can withdraw your money anytime.

Consider it an excellent holding area for your investment capital while you wait for other real estate investments or as a secondary emergency fund.

4. Private Notes

Alternatively, you can lend money to other real estate investors yourself. The legal document that the borrower signs is called a promissory note (or just “note” for short). It’s up to you whether or not you want to record a lien to enforce your loan.

I have lent a private note to Ohio’s real estate investing couple. They’ve paid me 10% interest every quarter since 2019.

Word to the wise, however: only lend a private note to investors you know personally and trust implicitly. Don’t lend money to anyone — even someone you know well — if they don’t have a long history of success in real estate investing.

Don’t count on earning a 15-30% rate of return like you might with a real estate syndication, but you can still earn solid returns with a steady stream of income.

5. Fractional Ownership of Rental Properties

In today’s world, you can do things with the click of a button, which was much harder even a decade ago. That’s the beauty of disruptive technology in real estate.

Case in point: investing platforms that offer fractional ownership in real estate. For $20–100, you can buy ownership shares in rental properties. You collect your portion of the cash flow through monthly or quarterly distributions and most real estate investing benefits. When the property sells, you get your share of the profits.

Sometimes, you don’t need to wait for the property to sell. Some online platforms offer a built-in secondary market where owners can buy and sell shares from each other. That means you can sell at any time (or at least after an initial 3–12 month holding period to prevent share churning).

Check out Ark7 and Lofty as examples of fractional ownership platforms that offer liquidity and secondary markets. Also, check out Arrived, the oldest and best-known of these platforms, which doesn’t offer a secondary market yet but has built a great reputation. Several platforms offer short-term Airbnb rentals, not just traditional long-term ones.

I have some money in fractional rentals on Ark7 and Arrived, but my favorite passive real estate investment is syndications.

6. Fractional Ownership of Apartment Complexes

What’s better than fractional ownership in a single-family rental property?

An ownership share in a 200-unit apartment community.

You benefit from an economy of scale, better cash flow, accelerated real estate depreciation, and higher barriers to entry, keeping returns high. The greater unit count provides stability; a single vacancy or repair won’t scuttle your returns. The vacancy rate typically remains pretty constant, as do maintenance costs.

You buy fractional ownership in multifamily properties through real estate syndications. These private investments typically pay 15–30% returns between cash flow distributions and profits upon sale. In some cases, the syndicator refinances the property rather than selling, returning your investment capital back to you even as you keep your ownership interest in the property. It’s one of earning infinite returns on your investment.

Plus, you get full real estate tax benefits.

There are several reasons: To begin with, they’ve historically been word-of-mouth investments among the wealthy. Most people have never heard of real estate syndications.

But even those who have often can’t invest in them. Many are only available to wealthy accredited investors, and most require a minimum investment of $50–100K.

7. Other Real Estate Syndications

Oh, one other thing about real estate syndications is that they don’t just include apartment buildings.

You can invest in any type of commercial real estate, from self-storage facilities to mobile home parks, campgrounds to marinas, assisted living facilities, and office space.

That means you can spread your money across many different industries and economic sectors. No matter the type of property, the tax advantages remain intact. You get to show a loss on paper for your tax return (at least in the early years), even as you rake in cash flow in the form of distributions. The paper losses help you offset your taxable income from other passive income streams.

8. Private Real Estate Funds

As a sister option to real estate syndications, you can invest in a fund with many syndications or other real estate-related investments.

Some closed funds have a fixed start date and target close date — they buy commercial properties, hold them for a certain period of time, then sell them and pay everyone out. Open funds rotate through assets, buying properties and holding them for a while before selling, but always holding a wide mix of properties and assets.

With some funds, you know exactly what they plan to buy. With blind funds, you don’t know exactly what properties they’ll buy, but you know the general partner and their track record and trust them to earn great returns.

Who Should Consider Passive Real Estate Investing?

Of course, it isn’t for everyone. I’ll break down who tends to do well with passive real estate investing.

Time-Strapped Professional: Passive investing is your friend if you’re earning good money but don’t have spare hours to manage properties. You get the benefits of real estate ownership without sacrificing your evenings and weekends.

Diversification Seeker: You may be heavily invested in stocks and bonds and looking to spread your risk. Passive real estate investments, especially private ones, can provide that true diversification you’re after.

Future Retiree: If you’re building your retirement nest egg and want steady, passive income streams, real estate investments can be a perfect fit. The regular distributions from REITs or syndications can help fund your retirement lifestyle.

New Investor: Starting with $50,000 for your first direct property purchase isn’t realistic for everyone. Passive investments let you dip your toes in the real estate waters with much less capital while learning from professional investors.

But hey, your investment choice should align with your goals, timeline, and risk tolerance. I started as an active investor but switched to passive investments when my priorities changed – there’s no shame in choosing the path that works best for you.

FAQs About Passive Real Estate Investing

I get it. You have some burning questions before investing in passive real estate. Say no more; I’ll address the most common ones I hear. If your questions aren’t answered, feel free to email us!

How Much Capital Do I Really Need to Start?

You can start with as little as $10 on platforms like Groundfloor. But realistically, I recommend having at least $1,000-$5,000 to build a properly diversified portfolio.

For really juicy opportunities like syndications, the minimum is typically $50,000+ unless you join an investment club that offers lower minimums.

What’s the Absolute Simplest Way to Get Started?

Public REITs, hands down. You can buy them through any regular brokerage account, just like stocks. But remember what I said earlier – they tend to move with the stock market, which defeats some of the diversification benefits.

If you can handle a bit more complexity, I’d suggest looking into private REITs or crowdfunding platforms.

What About Risk – How Bad Can It Get?

Every investment carries risk, and real estate isn’t immune. But here’s why I love passive real estate investing: you’re spreading your risk across multiple properties and locations rather than betting everything on one property in one neighborhood.

Plus, professional managers handle the day-to-day headaches instead of me.

Final Thoughts for Passive Investors in Real Estate

There is no single best passive real estate investment strategy. All of the investment strategies above have their place and their pros and cons.

While I would never discourage anyone from becoming a landlord or buying real estate directly, I do always ask them a question: How passionate are you about investing in real estate as a side hustle? Because that’s what it is — buying properties yourself is like working a part-time gig. That’s fine if you’re willing to learn the skills you need to succeed and put in the work to execute your plan.

But most people don’t want a real estate side hustle. They want to diversify their investment portfolios to include real estate, ideally featuring many properties. And for them, I recommend passive investing in real estate.

This article originally appeared on SparkRental.com and was syndicated by MediaFeed.org