Passive income is the financial dream of earning money with minimal effort. It is crucial for long-term financial security and growth.

show

Cash flow appreciating assets can offer this passive income while increasing in value over time. By diversifying across different assets, you can build a steady stream of revenue.

10 Best Cash Flow Appreciating Assets to Earn Passive Income

Cash flow appreciating assets are investments that generate regular income and grow in value. Such assets can offer the dual benefits of immediate returns and future wealth.

These investments are often sought for their potential to hedge against inflation and provide financial stability.

Real Estate Investments

Real estate is a leading choice for passive income. Properties can increase in value while offering rental income.

Residential Rentals

Investing in residential rental properties starts with the right location and a good eye for property valuation.

Choosing properties in high-demand areas increases your chances of consistent rental income. Effective property management also plays a vital role in the success of residential rentals.

Commercial Properties

Commercial real estate typically involves longer-term leases. This can provide a stable cash flow. Investors in commercial properties need to understand market trends and business tenants’ needs.

Real Estate Investment Trusts (REITs)

REITs allow you to invest in real estate without owning physical properties. They offer liquidity and are a good way to enter the real estate market with less capital. REITs also provide tax benefits that can enhance an investor’s return.

Dividend-paying Stocks

Stocks that pay dividends offer an income stream along with potential appreciation. It is vital to choose companies with a strong dividend history. Reinvesting dividends can compound your investment’s growth over time.

Business Ownership

Investing in a business can provide passive income if the company pays dividends. The key is finding a business with growth potential that doesn’t require constant involvement.

Peer-to-Peer (P2P) Lending

P2P lending involves loaning money to individuals or businesses through online platforms. It can be risky, but with the proper research, it can provide higher returns than traditional bank products.

High-Yield Savings Accounts and Certificates of Deposit (CDs)

These accounts offer better interest rates than standard savings accounts. CDs are time-bound deposits with higher interest rates. Laddering CDs ensures you have access to funds without sacrificing returns.

Bonds

Bonds are loans to a corporation or government, with interest payments to the investor. They range from lower-risk government bonds to higher-risk corporate bonds.

Royalties from Intellectual Property

Investing in intellectual property like music or patents can generate ongoing royalties. It requires a keen eye for valuable creative works or innovations with commercial potential.

Precious Metals and Collectibles

Gold and other precious metals often retain value and appreciate over time. Collectibles can be a unique asset, but their value is highly dependent on rarity and demand. Study the market well before investing.

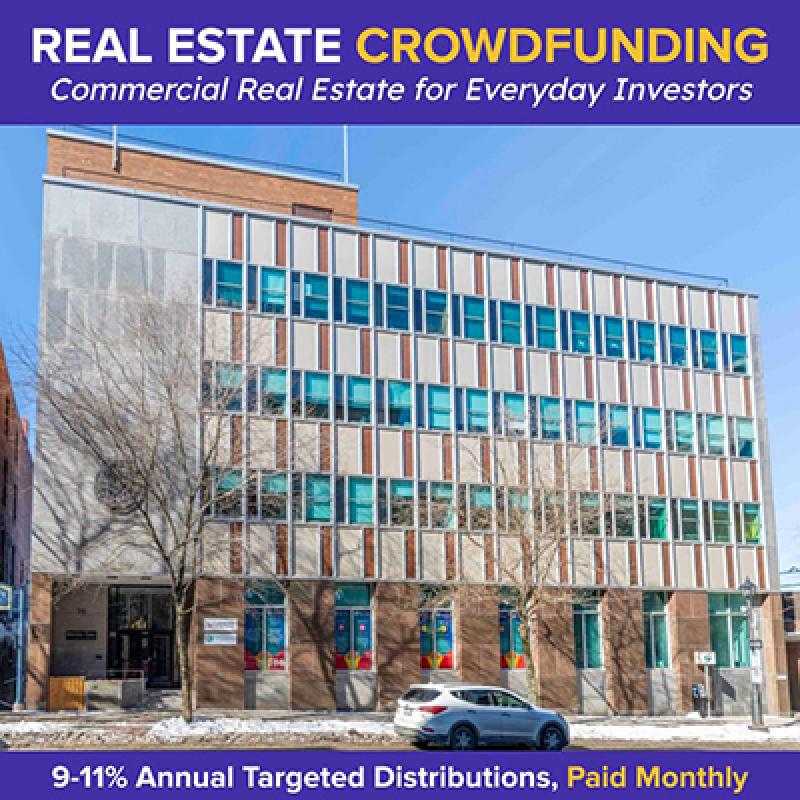

Crowdfunding Ventures

Crowdfunding allows investors to fund new ventures in exchange for equity or rewards. Vetting projects is essential to reduce the risk of loss.

Annuities

Annuities are contracts with an insurance company designed to pay you a regular income stream. They can be a part of a retiree’s portfolio, offering a fixed or variable income.

Frequently Asked Questions

Before concluding, let’s answer some common questions about cash flow appreciating assets.

How do you assess the risk versus reward for cash flow appreciating assets?

Evaluate each asset’s potential return against its inherent risks. Consider your financial goals and risk tolerance. Consult a financial advisor for tailored advice.

What are the tax implications of earning passive income from these assets?

Tax laws vary by investment and jurisdiction. Generally, passive income is taxable. Specific assets may offer tax benefits. An advisor can offer guidance based on your situation.

How much capital is typically needed to start investing in cash flow appreciating assets?

The required capital varies widely. REITs and high-yield savings accounts have lower entry points. Direct investments like real estate or business ownership often require more capital upfront.

Can you create passive income with no initial investment?

Creating passive income without investment is challenging but not impossible. Creative endeavors or leveraging your skills for royalty income could be options.

What are the best passive income assets for beginners?

Beginners may start with lower-risk investments like high-yield savings accounts, CDs, or basic REITs. These can offer initial experience with passive income assets.

How can one balance the need for cash flow with the desire for asset appreciation?

Diversify your portfolio. Include both high-yield, lower-growth assets for cash flow and growth-oriented assets for appreciation. Adjust based on performance and financial goals.

By carefully selecting and managing a range of cash flow appreciating assets, you can establish robust streams of passive income. This approach can lead you to financial independence and a well-rounded investment portfolio.

Always remember to do your due diligence and consult with professionals to align your investments with your personal financial situation and goals.

Conclusion

Investing in cash flow appreciating assets can diversify income and build wealth. It is crucial to research and consult financial professionals before venturing into these investments.